Like many of today’s leading online marketers, LendingTree has ramped up its investment in content-related initiatives. The company’s website offers a wide range of educational materials that connect visitors with relevant and actionable personal finance advice, as well as customized loan offerings.

Lending tree boosts site engagement with retargeting.

These new assets play a big role in boosting on-site engagement for LendingTree, but the company’s marketing team was also looking for ways to promote that content across the web, driving new customer acquisition.

Taboola’s discovery platform offered not only a premium site list with highly-engaged audiences, but also a way to navigate one of LendingTree’s biggest challenges: the fact that decisions related to personal finance are often multi-step journeys.

Taboola’s Internal Retargeting capabilities enabled LendingTree to strategically promote (and re-promote) its content to new audiences across the web.

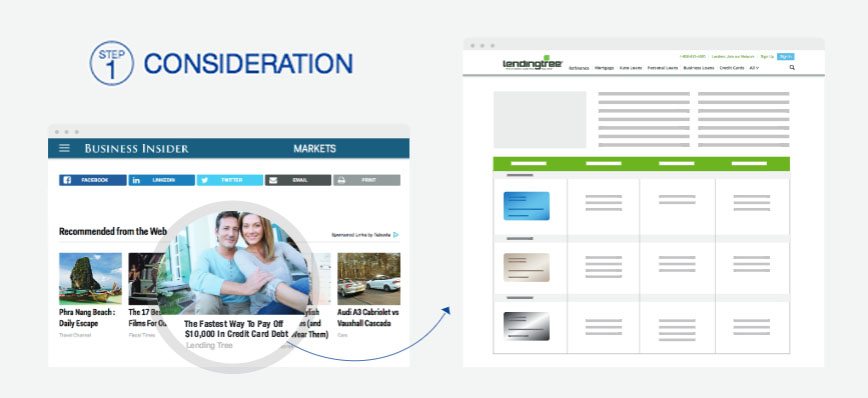

First, Taboola matched LendingTree’s comparison-style articles with relevant users, educating them about new credit card offerings while also providing ample conversion opportunities.

Then, Taboola and LendingTree specifically re-engaged those users that had clicked on a related campaign (but did not convert), driving them towards a more focused landing page that emphasized the main value propositions.

Our teams published a case study about the collaboration, which found that Internal Retargeting enabled LendingTree to lower its cost-per-acquisition (CPA) by 65 percent and increase its conversion rate by over 100% across Taboola’s network.

Check out the full write up for more details about the partnership, and visit the Taboola resources page to browse our other case studies, data sheets, webinars, videos, and ebooks.