There’s no two ways about it—money is a concern right now for finance consumers everywhere. Unemployment now rivals that of the Great Depression, and many people across the globe have found themselves out of work.

Plus, the lucky who have been able to continue working are wondering how long that might last, and what, if any, are the best financial moves to make right now to prepare for the future.

If you’re going to tap into these audiences effectively with your next advertising campaign, you’re going to have to focus on what really matters to finance consumers right now—meaning providing value where you can, and empathy across everything you do.

Finance Industry Benchmark Report

In short, you’ll need the answers to the tough questions:

- What moves are finance consumers looking to make short term, and why?

- How can I stay valuable while aligning myself with those interests, moves and concerns, while staying effective long-term?

The answer to these questions lies in the way these consumers are currently consuming content online. Using data from our network of 20,000 publishers, advertisers and digital properties, we’ve surfaced some trends about finance consumers, including their current interests, when and how to reach them online, and creative strategies to support you in building an effective advertising campaign.

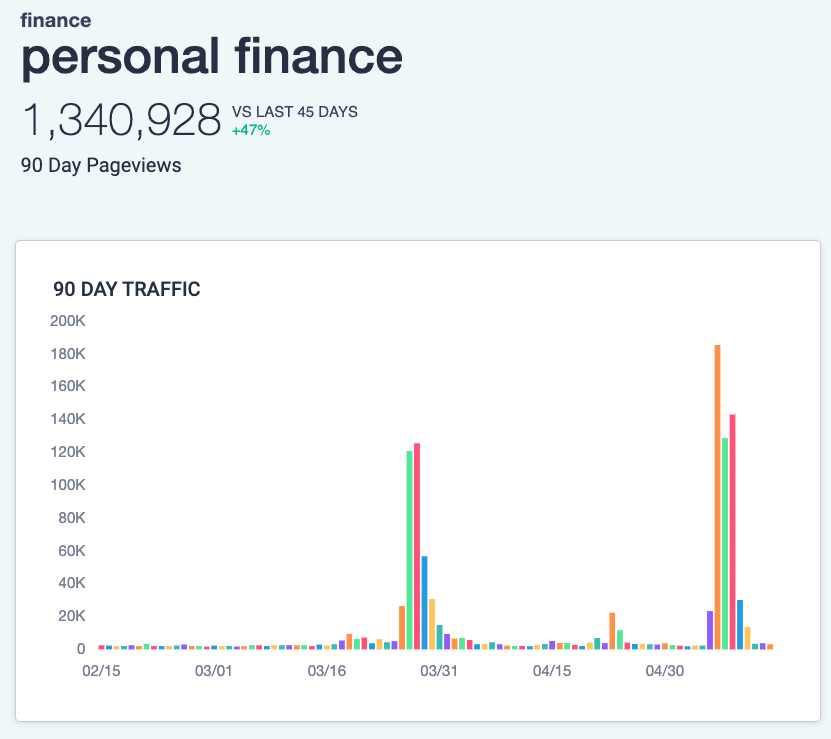

As a whole, personal finance is having a moment—we’ve seen a 47% increase in pageviews in the last 45 days, posing a big opportunity for finance advertisers who need to meet those consumers while they’re engaged.

To really understand why, we took a look at a couple of layers of interest to see the topics that really stood out.

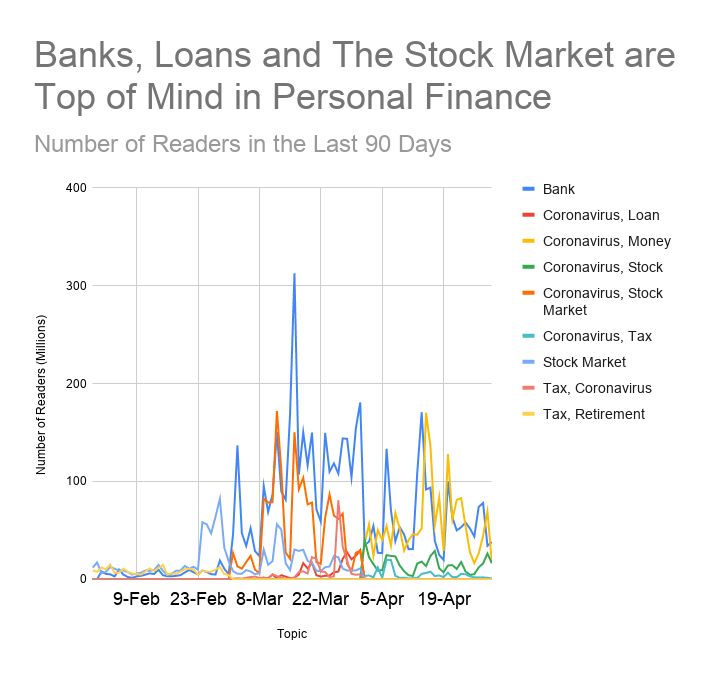

Consumers Look for Investment Advice and to Banks in the Wake of Financial Uncertainty

We’ve officially hit unemployment rates that rival the Great Depression, and consumers are feeling concerned about their financial futures. On top of this reality, a bear market has spurred interest in those looking for financial advice, in the hopes they’ll see a return on their investments when the market comes back.

In the wake of these two events, content including tips and strategies for investment is clearly at the forefront:

In order to uncover some secondary topics, we removed investment content from our analysis and surfaces trends that indicate people are turning to their banks for advice on money, the stock market, and a potential loan.

For advertisers looking to reach consumers during this time, addressing these clear concerns in your campaigns will help you stand out.

- If you’re a bank or in the financial space directly related to investment, you’re having a moment, and you should be looking to advertise

- If you’re not a bank or and investment technology, consider how your products help people find short-term funds, or grow the money they currently do have.

Build Creatives that Align with Today’s Personal Finance Consumer

A campaign theme or direction is just the first step—how does this advice actually shake out in your creatives?

Ads on publisher sites always include a headline and an image—they’re what you have to work with during your open opportunity to capture consumer’s attention.

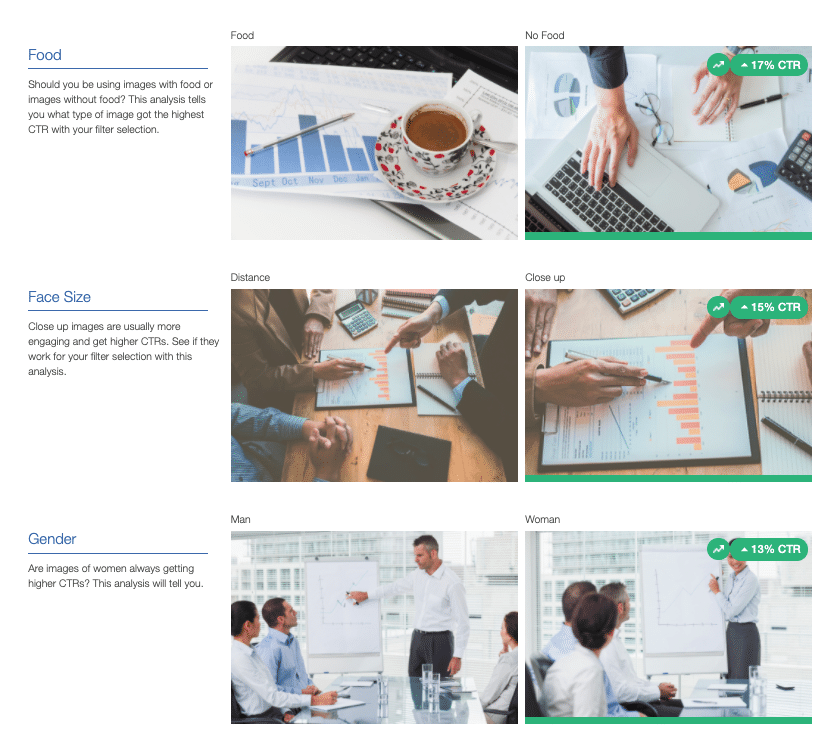

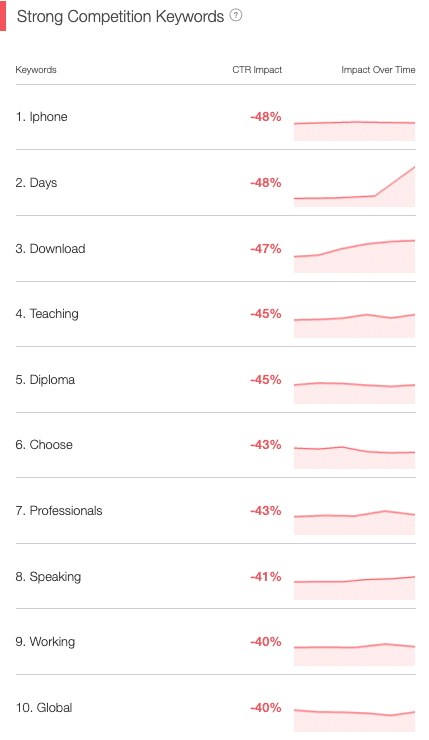

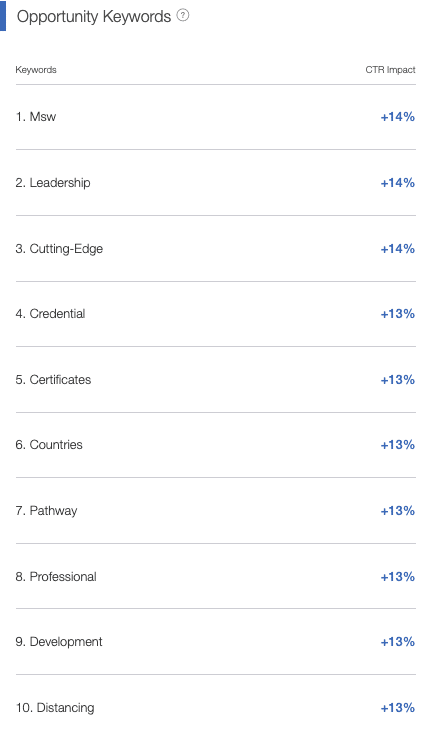

Using the millions of ad creatives running through our network each week, we surface image and headline trends that increase advertiser CTR with Taboola Trends.

You’ll want to stay away from images without food, keep photos close up, and include photos of women.

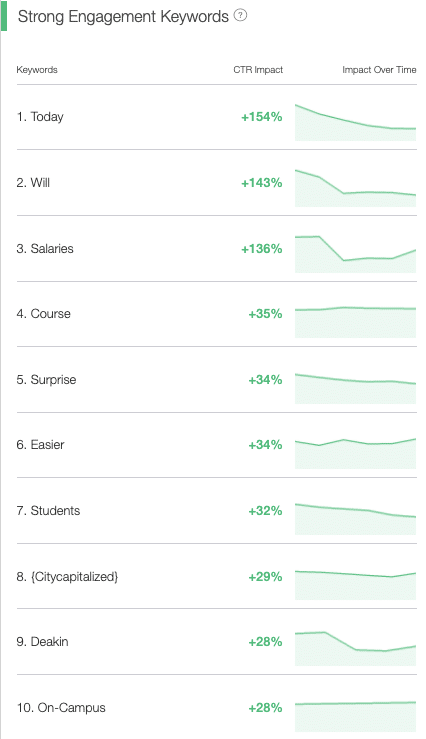

When it comes to your headline, including certain words can help. We’ve surfaced those keywords that are seeing high CTRs, those that we’re starting to see creative fatigue for, and those that are upcoming.

You can use these keywords to draft headlines that align with your current theme, increasing your chances of a high CTR. Here are some example headlines, based on these trends and the readership data we shared earlier:

- Rebalance Your Finances with the Right Financial Advising

- Investment Technology SlashedNewbie Hesitation

- How to Make Money on the Internet

- Beat Debt in a Recession with These Five Tips

- Senior Discounts on Financial Planning and Retirement Plans

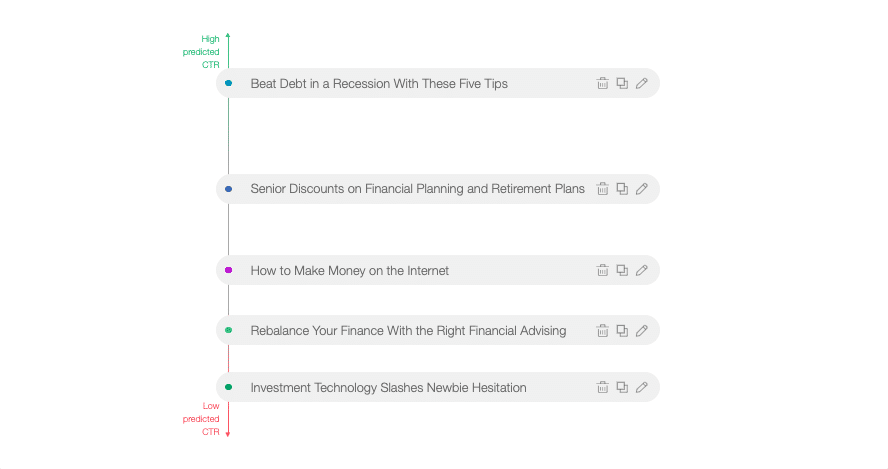

You’ll of course want to A/B test which work best for your particular audience. In addition, our predictive title tool analyzes your headlines for their predictive CTR, and will rank them depending on which our algorithm thinks will be the top performer for you. Here’s how those example headlines stack up against one another:

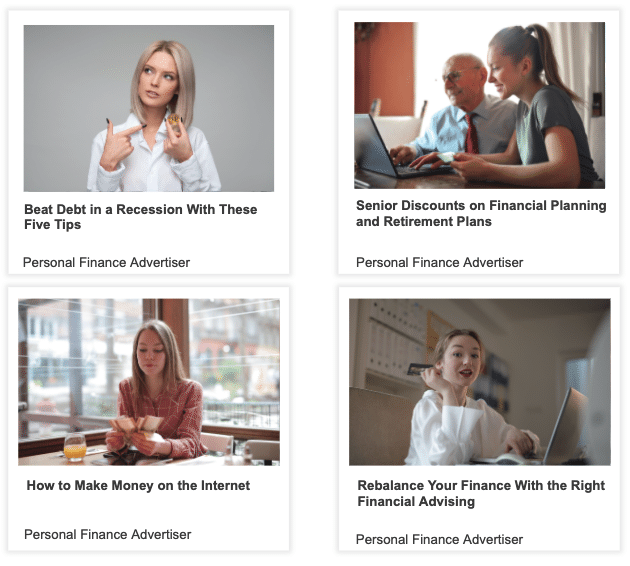

All that’s left is to combine those image and keyword insights to build creatives you can feel confident testing. Here’s what some of those creatives might look like, using our image trends and tested headlines:

We recommend testing nine creatives with each campaign, and monitoring weekly to determine which creative performs the best. To build nine creatives easily, take three headlines and three images that you can mix and match to drive traffic to the same landing page.

Target Personal Finance Consumers When and Where They are, and With the Right Type of Content

Formerly, interaction with content from finance advertisers had a lot to do with the workday and the work week. Now as many are home more often, some of those trend have shifted slightly.

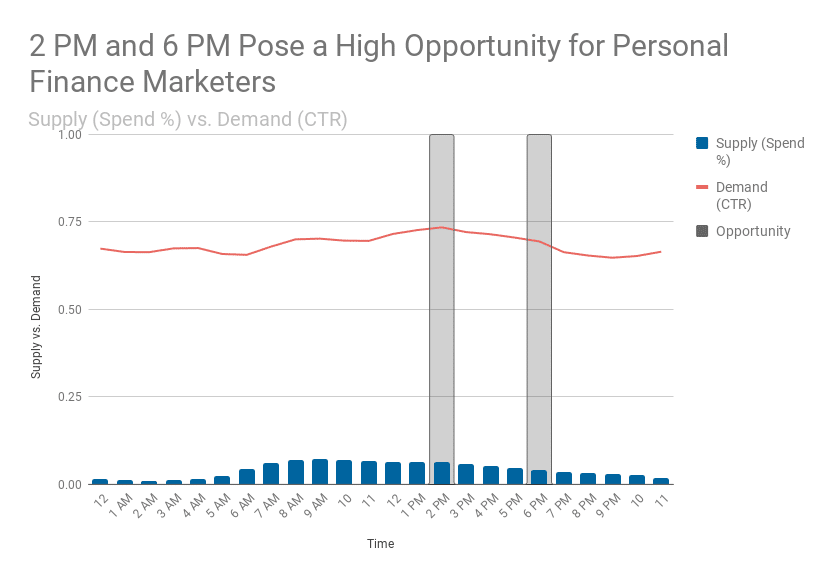

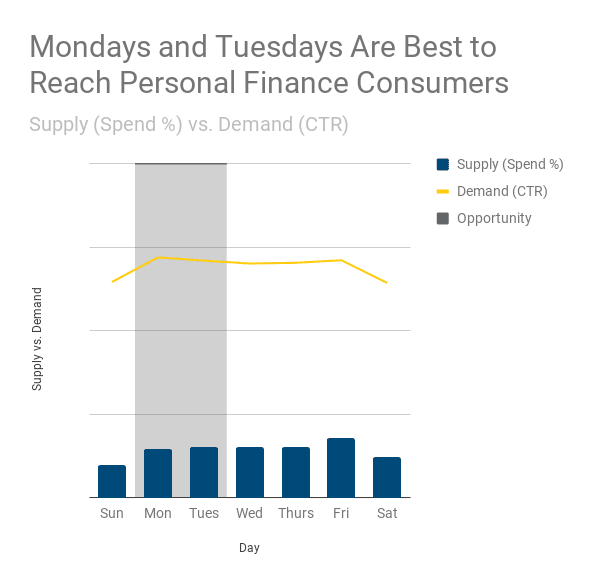

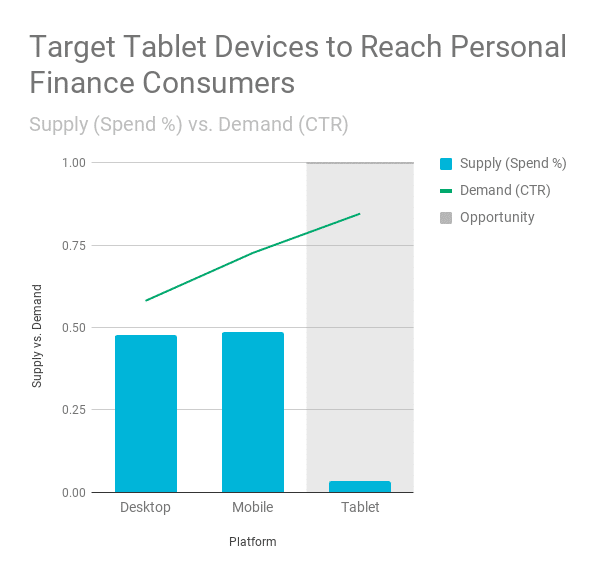

In order to determine the best opportunities for advertisers when it comes to targeting, we take a two things into account: click-through-rate (CTR), or demand for content (if you’re clicking on content, we assume you want to see it), and spend % across our network, or supply of education-related content available to consumers. At times where there is a low supply of content, and high demand for that content, that’s the biggest opportunity for advertisers to capitalize on.

Whereas mornings used to be best, now there’s more opportunity in the afternoon.

The work week is still king—try reaching consumers on Mondays and Tuesdays.

Finance advertisers are sorely missing out on opportunity in tablet devices, for which we’re seeing CTRs rise and supply wane.

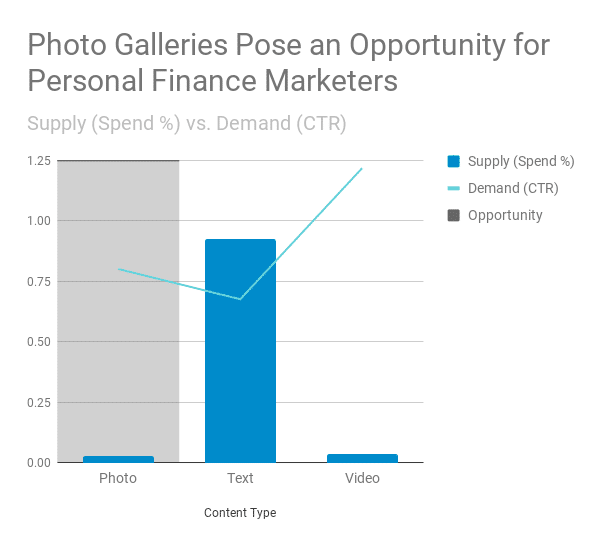

You might naturally think text-based content is the best format in which to provide financial information or advice. Our research shows visual content and video are actually more enticing, and less saturated:

Once you’ve mastered the where, when and how, use data segments to ensure you’re finding the right people.

Example Data Segments

- Interest > Finance > Personal Finance

- Interest > Finance > Personal Finance > Lending

- Interest > Personal Finance > Credit Cards

- Interest > Finance > Investments > Personal Investments

- Interest > Finance > Investing > Funds

- Interest > Finance > Investing Technology

- Interest > Finance > Investing > Stock

Maximize Your Bid

You must bid right if you’re to break through the noise. For those beginners, we recommend bidding as high as you’re comfortable with for the first few days to a week, to capture as much traffic (and therefore data) as you can in order to determine how to target more effectively.

Here are some best practices you can follow:

- If your ad has low conversions and it’s served 300-500 clicks, pause it.

- Adjust your bid per site before blocking specific sites altogether if your CPA is high.

- Only bid down on a site entirely after delivering 500 clicks with no conversions

- Increase bids by 25%-50% for top-performing sites to increase their competitiveness

Our Smart Bid feature automatically bids for you based on your goals, allowing advertisers to rest assured their getting the best rate for each click.

Example Personal Finance Examples to Inspire

These banks and personal finance advertisers have seen success on publisher sites—we hope they’ll inspire your own campaigns.

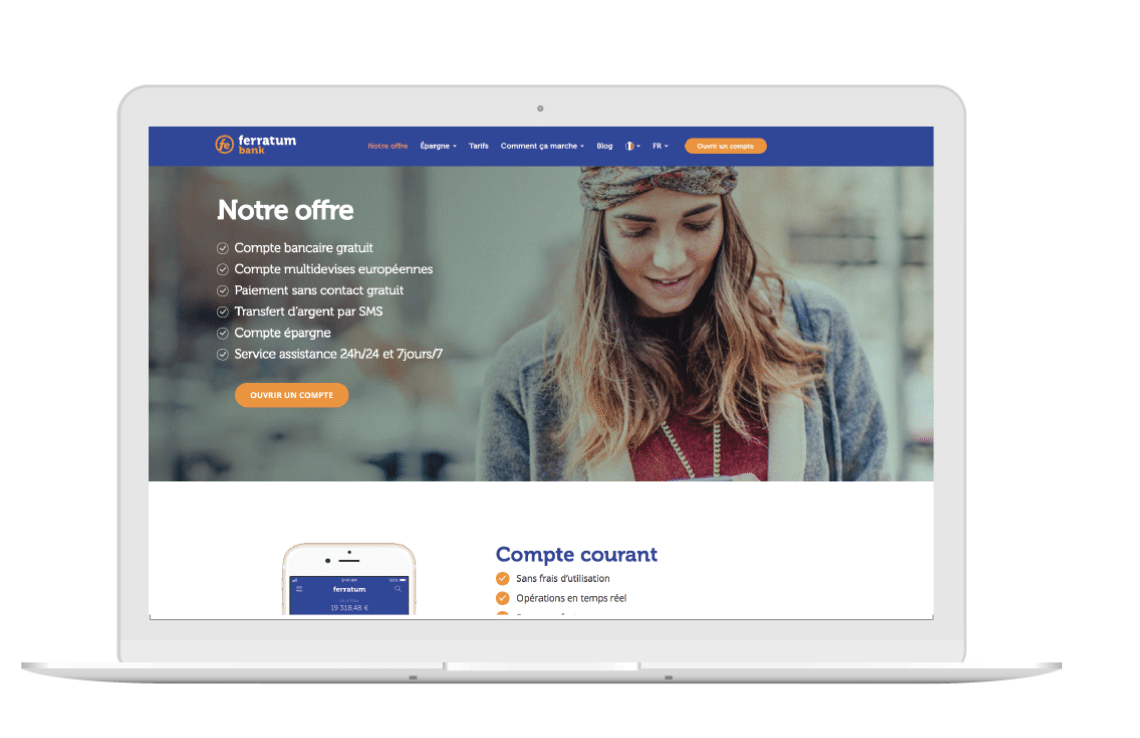

Ferratum Bank Doubles Website Traffic

Ferratum Bank is a new mobile banking player, and a subsidiary of Finnish Group Ferratum. Its 100% online and mobile banking service has been available in France since 2017.

Ferratum Bank wanted to focus first on brand awareness by recommending quality from their blog. They then expanded to a more direct and incentive-based approach, by distributing content that invited consumers to discover its services. The content highlighted the benefits of opening an online bank account with Ferratum Bank.

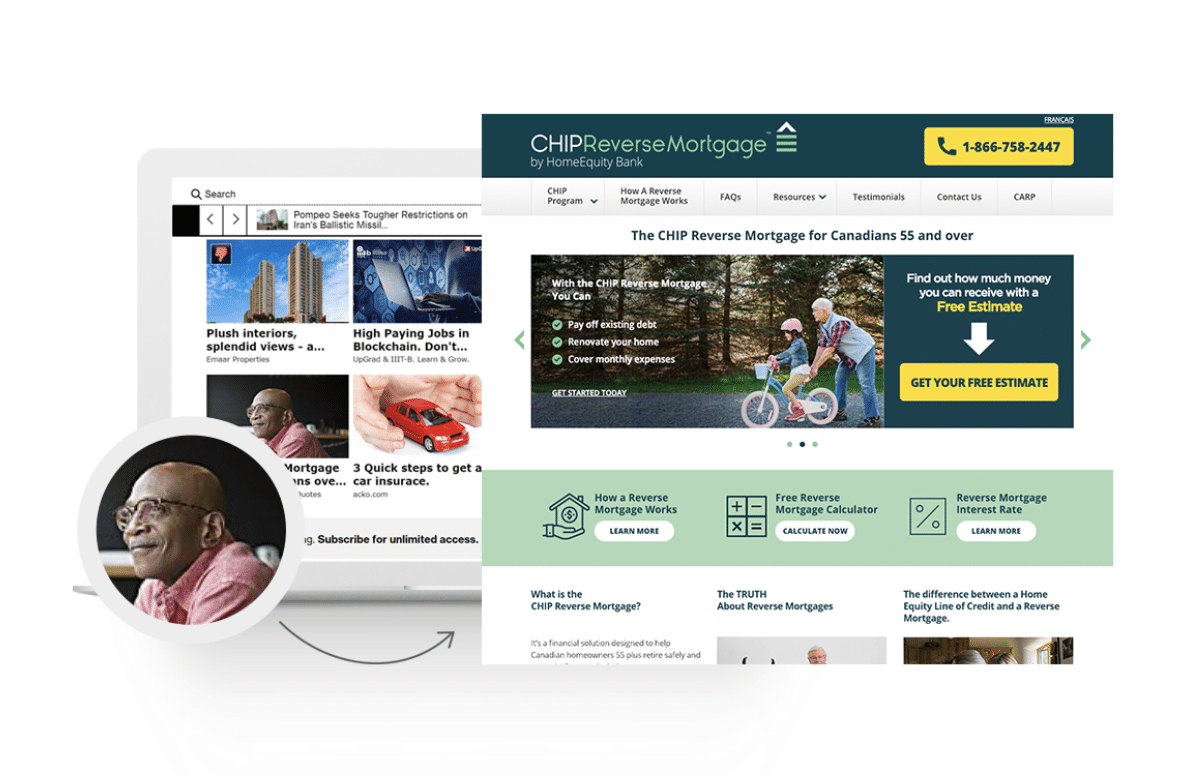

Agency iQuanti Drove Over 1,000 Mortgage Leads for Home Equity Bank

To achieve HomeEquity Bank’s conversion goals, iQuanti ran multiple campaigns with different targeting tactics—including audience segmentation, retargeting and audience segmentation.

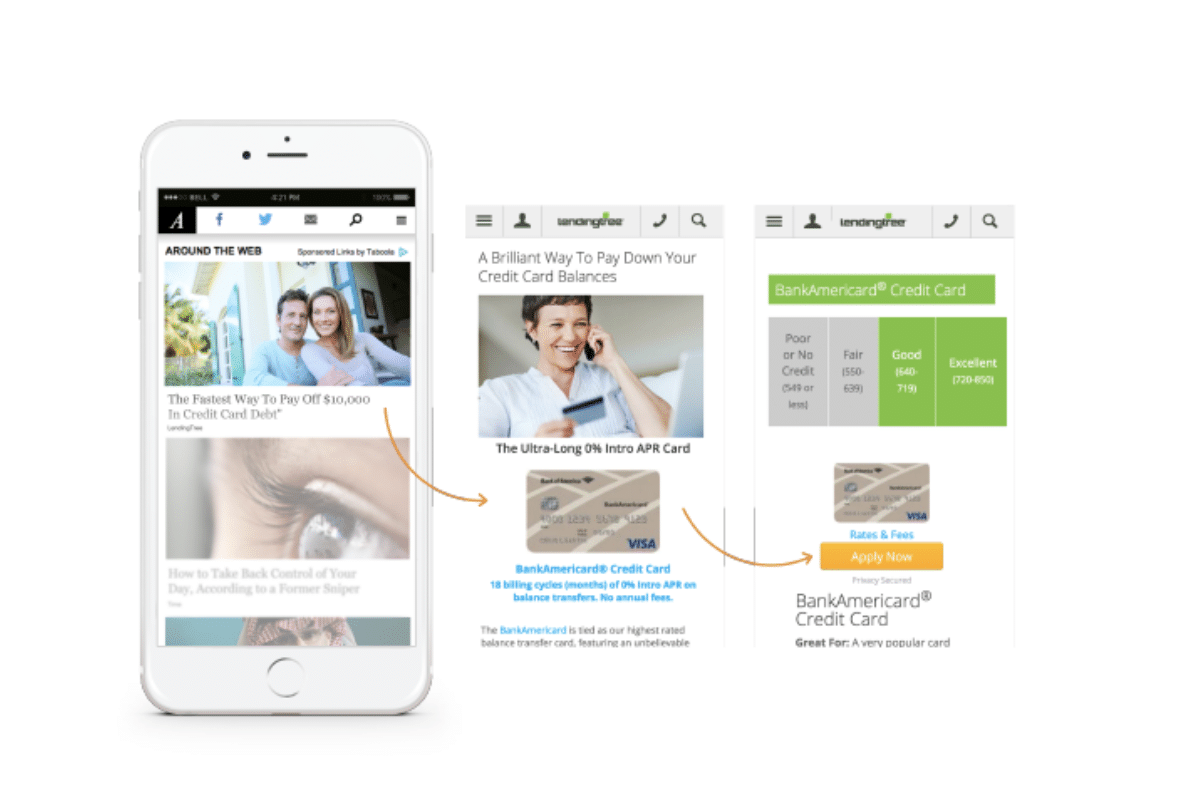

Lending Tree Lowered CPA when they Implemented Retargeting

Lending Tree used articles to educate consumers about various credit card offerings, and drive new purchases for LendingTree.

Consumers could click on cards throughout the piece to learn more about a particular option, and prominent “APPLY NOW” buttons direct them to the appropriate bank website when they’re ready to make a decision.

Conclusion: Meet Personal Finance Consumers with Content That Addresses Their Current Concerns

Money issues are real right now for many people across the globe fighting a loss in the ability to work, and uncertainty when, or if, they’ll be able to get back to life as they knew it. For advertisers, this means an opportunity to be a leader in how consumers can think about their finances strategically in a challenging time.

The key to successfully reaching those consumers is founded in being empathetic to their current challenges, desires and needs.