There’s been a lot of moving and shaking beneath the feet of the advertising industry this year. Many companies have gone public, and it seems those companies have answered the timeliness adage “buy or build,” with a resounding buy.

So, what’s so special about this moment? Why is all of this happening now, as opposed to last year or even five years from now?

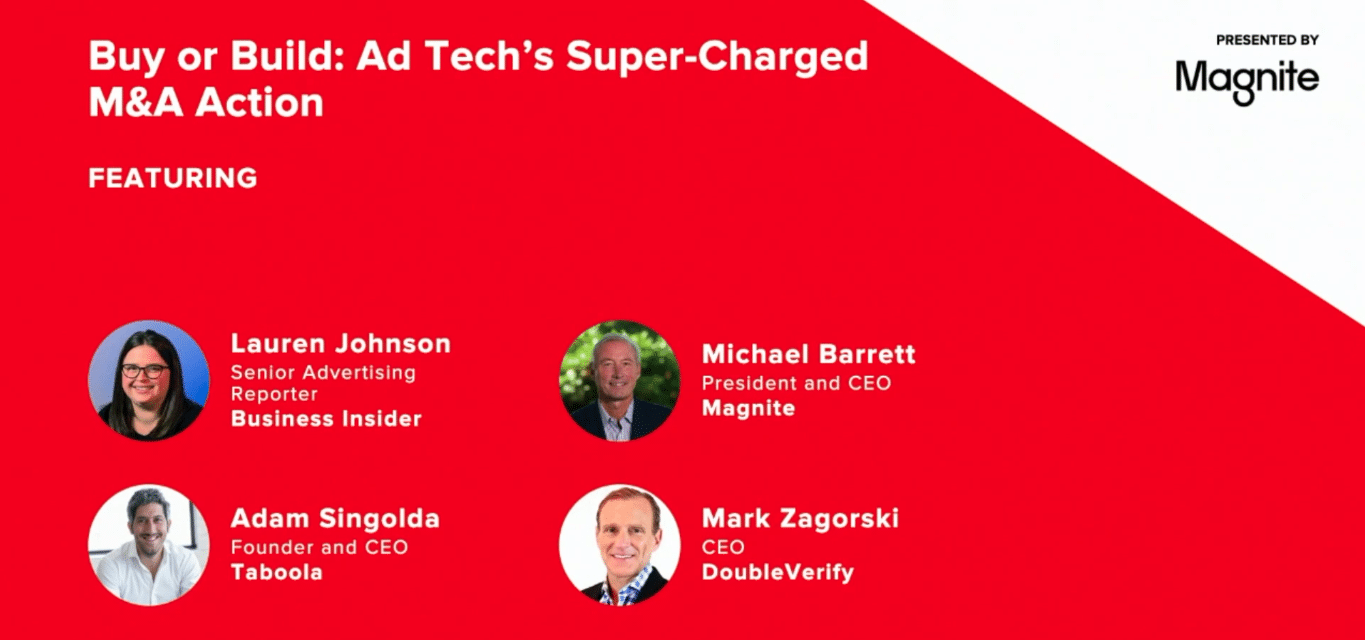

Adweek’s Sr. Advertising Reporter Lauran Johnson answered this question live on the AdvertisingWeek stage with Taboola CEO Adam Singolda, CEO of Magnite, Michael Barrett and CEO of DoubleVerify Mark Zagorski.

Why is the advertising industry seeing all of this merger and acquisition activity?

Panelists shared two driving forces behind the recent increase in mergers and acquisitions (M&A): a recent focus on scale; and a push from brands and publishers to consolidate the numbers of partners they work with.

“People are really starting to understand that scale matters,” Zagorskis said. “There are opportunities for businesses to scale through M&A, and it’s the fastest way to do it. You’re either big or roadkill.”

Singolda added that a burning need to diversify away from walled gardens has been a major contributing factor:

“People want to have less vendors and more partners,” Singolda said. “They want to invest more with less companies, but do a lot more with them. Especially as we’re thinking about a world where clients or advertisers are looking to diversify as much as they can outside of walled gardens, the Facebooks of the world, the Googles of the world, it’s so important for them to build successful relationships with companies.”

In the infant stages of advertising on the open web, there was a fear that Google would crush the competition. That’s no longer the case, which fuels confidence that many technology companies in the advertising space that aren’t Google will only get bigger.

“The bust occurred at the first wave of adtech companies,” Barrett said, “Those guys were mostly glorified rep firms that could scale revenue faster, but weren’t the best companies. Public investors lost confidence in adtech because they really felt Google could do everything.

There was a wilderness where everyone thought adtech was over because ‘Google is going to do it anyway.’ What people are finding is that for the open web you need non-Google companies, and Google’s aspirations have also changed over time. They’re not looking at running the table for the open web and the open web is a huge piece of the economy. It demands scale and differentiated companies.”

How has the pandemic affected the industry?

The pandemic sent a record number of people online, which inarguably supported growth in online advertising.

But what really made a huge difference was that the world really stood up and realized the importance of an online presence for businesses of all sizes, despite the fact that we’ve all been talking about it for years.

“I’ll tell you the things that changed in the last year, Singolda said. “It’s funny, we’ve been saying it’s important to go digital for the last decade. Still, last year you saw that there was no choice because stores were closed and we were all stuck home. Many businesses had no choice but to go digital faster. In many ways we were in the future at once.”

Retailers have started to build their own solutions to challenge the likes of Amazon and Walmart, is there an opportunity there?

While many companies of all different types — from retailers to publishers to OEMs — have looked into what they can build themselves, there is a point where the buck stops and they want to rely on a third-party.

“Our largest clients are OEMs,” Barrett says. “They’re preferred method is automated or programmatic. Most of them stop short of building that component themselves. They want to work with a third-party to help. They want to control the inventory, and protect their environment and consumer experience, but they do need a tech company to work with them.”

Because they still want to partner with technology companies, retailers have driven the advertising industry to step away from vanity metrics and focus on real business outcomes.

“The only thing to know about retail media which I think is so exciting,” Zagorski says, “The retailers got so fed up with the space because they wanted to drive outcomes. Specifically when we look at DoubleVerify, the idea of moving away from traditional measurement proxies and moving into actually helping advertisers drive an outcome is where the world is going.

The retail media guys were like ‘we’re not going to wait for you, we’re going to try to do this ourselves.’ It creates a compelling drive for the industry, and particularly companies like DoubleVerify in the measurement space.”

The trend towards e-Commerce may have started with fed up retailers and the pandemic, but it’s only going to keep growing.

“We just acquired a company called Connexity,” Singold says, “Snd the reason we took that bet was because we thought that retail and e-Commerce would be such a big part of the future on the back of the pandemic.

One, people are buying online so much more. Two, everyone wants to diversify outside of those walled gardens, and three, the transition from cookies to context and the growing importance of this notion of trust continues, when you go to a website like a CNET or Wirecutter and you read about something that you like, you’ll consider making purchase decisions.

The opportunity to link those retailers with content people trust is such a big part of what people think is about to happen.That’s why we’ve taken that bet.”

How has working virtually or working from home affected your businesses?

The hardest part about corporate decisions surrounding work from home in the online advertising space has been keeping connections between people alive.

“It’s been a bear,” Barrett said. “We never even got a chance with the merger to get the two companies together, and then of course there have been other acquisitions after that. It just compounds the challenge of building a culture.”

Aside from employee connections, it’s been a valuable experience when it comes to working with investors.

“With relationship to actually coming out going public,” Zagorskis sais, “we did our entire roadshow, a private placement of $150 million before our IPO, and we did it all virtually, and I have to say that the investors loved it, the analysts loved it, because you didn’t have to waste time on planes. We had more meetings with investors than we ever could have done flying around everywhere. It has made the capital markets almost more accessible in this virtual way. And I was home every night having dinner with my family as opposed to on the road.”

Despite the lack of travel making things easier on both employees and investors alike, virtual working does bring culture to the forefront of the discussion.

“It puts such a huge emphasis on culture,” Singolda says. “What does transparency mean? How do you communicate with each other? How do you innovate? We went public and raised over $1.2 billion dollars and I never left my house in Tenafly, NJ. But it worked. It was madness.

We have the best offices in the world, and everyone told us we miss people, we miss people, we miss people. Then, we opened the offices, and nobody came back. So, I mean, I’m not dismissing social impact. I miss people, but people also realized they can be productive being away and some of this I think is never coming back. I haven’t given up my offices, and I hope people come back.

I’m not sure we’ll force people to come back. Something in us changed forever when we realized we could go public from a home with your kids making noise outside and that’s okay. So, what will the future look like?”