In the midst of COVID-19, consumer needs are changing. Some industries have found themselves high in demand, while others are seeking new and creative ways to reach consumers in a world where most people are home.

In the midst of COVID-19, consumer needs are changing. Some industries have found themselves high in demand, while others are seeking new and creative ways to reach consumers in a world where most people are home.

Today’s trends in advertising are reflecting these changing needs. We took a look into advertising activity on the Taboola network to analyze the industries in which we’re an influx of campaigns (based on spend percentages), advertiser KPIs during this crisis, and the verticals in which we’re seeing the highest demand for those campaigns (based on click-through-rates (CTRs)).

Three verticals have risen to the top—entertainment, fashion and lifestyle—for which we’ve also provided insights to advertisers looking to reach consumers authentically and effectively during this global pandemic.

Trends in Advertising Campaign Supply, Demand and KPIs

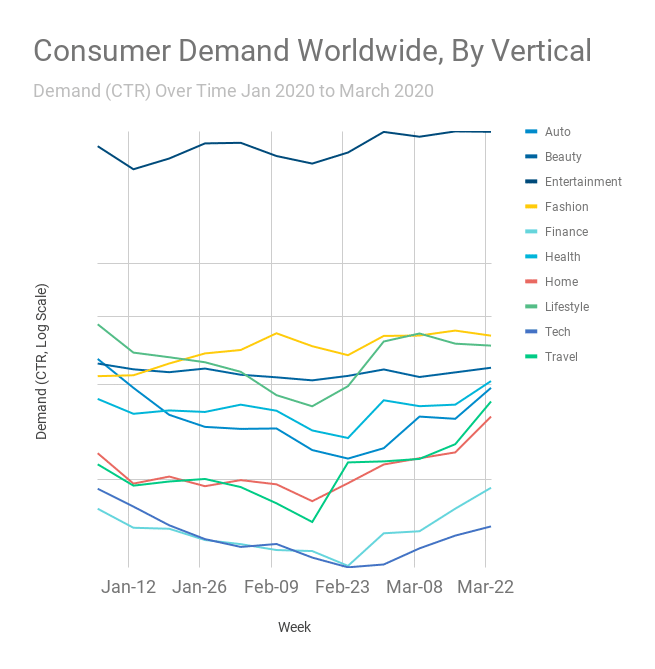

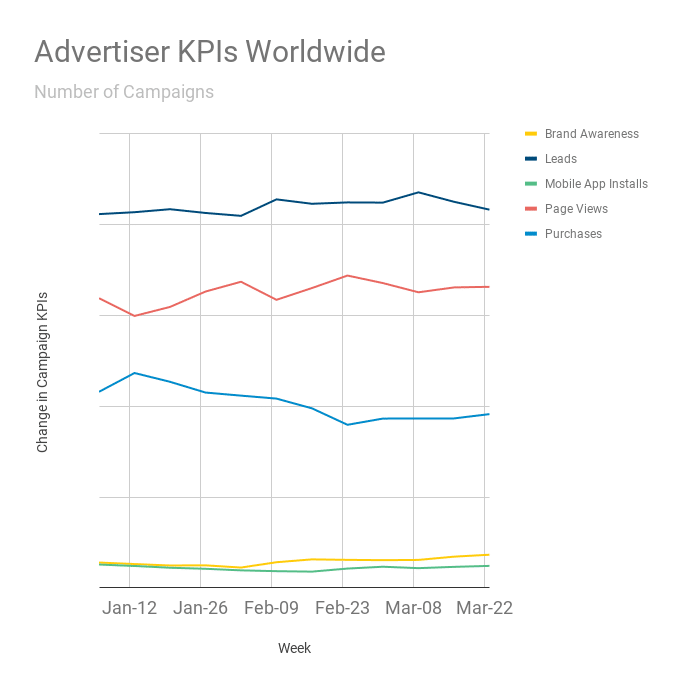

We took a look at the supply (defined here as spend %) and the demand (defined here as CTR) for different industry advertisers, as well as a look at the trends in KPIs being targeted.

We’re seeing an increase in supply of content recommendations and campaigns from advertisers in the industries most relevant to consumers at this time.

Entertainment, finance, and health are all among verticals who are increasing the amount of content and campaigns they’re distributing at this time.

Given those industry’s possible positioning within a global health crisis, it can be assumed that people will consume more content related to information, resources, and tools to prioritize their health, manage their personal finance, and seek ways to keep themselves occupied as people adjust to working and operating out of their homes

As far as consumer demand goes, entertainment still ranks quite high. In fact it’s so high that we’ve presented this graph on a log scale to more clearly show activity in the other verticals.

Demand for fashion and lifestyle content are two verticals aren’t necessarily being met by supply, indicating an opportunity for advertisers today. Perhaps people are looking for resources such as how to keep kids busy when they’re home from school, or how to clean their phones.

As far as fashion goes, this demand might not indicate just your regular clothing buys—but maybe interest in a general shift to e-commerce, functional fashion for those in need, or even a desire to support local businesses.

Lead generation and pageviews are amongst advertisers top priorities in the past quarter across all categories, with purchases not far behind. This could indicate prioritization of performance marketing over branding campaigns in for advertisers looking to make up for revenue they might be losing due to consumers in both self- and mandated quarantine.

Let’s circle back to the three industries seeing high demand—entertainment, fashion and lifestyle. One of which is meeting consumer demand, while the other two aren’t quite doing so, posing an opportunity for advertisers.

We’ll run through some more of the specifics, as well as trends specific to those verticals and how they can be applied creatively to help connect consumers with products, services, and information they may want or need.

The Rising Supply and Demand of Entertainment

With more and more people staying in their homes, it should come as no surprise that both the demand for entertainment content, and the spend by entertainment advertisers to deliver it have seen a spike.

Specifically, we’re seeing that people are interested in celebrities—from the queen, to Tom Hanks, and even the Kardashians. People are reading about how COVID-19 is impacting celebrities, what they’re doing about it, but also consuming this type of content the way they would regularly.

There’s also an influx in content around games, video games, television shows, movies, and more that people are using to fill some of their time.

Entertainment Image Trends

In line with the increased content consumption around celebrities are the image trends that emphasize simplicity, and getting right to the point.

Photos of people without text on them are proving to be effective entertainment advertising content.

Entertainment Keyword Trends

Across the board, celebrities and the royal family are showing up among the trends, along with words that allude to games.

Entertainment Ad Examples

Putting together the image and keyword trends coming up for the entertainment vertical, these are three ads that may be most effective for getting a message across to consumers.

To see how these principles can be applied, this Instagram post from Netflix is a great example.

This engaging post features celebrities and offers up recommendations for TV shows or movies to watch (which, by the way, they did a good job trying to stick with).

Fashion’s Rise in Demand Calls for More Supply

As mentioned above, the fashion vertical is experiencing an increase in click-through rates, indicating a consumer interest or need.

This increased demand for fashion content could be sparked by a general switch to e-commerce (including clothing), or it could be people looking at how the clothing brands they love are responding to COVID-19, or perhaps people looking for some clothing essentials or basics during this time.

Fashion Image Trends

Current trends in fashion imagery point to photos of female subjects with food and without animals.

Fashion Keyword Trends

Some of the higher competition keywords indicate an interest in comfortable clothing, while some of the higher engagement and opportunity keywords indicate fashion clicks related to human behavior and trends.

Fashion Ad Examples

According to the fashion image and keyword trends, these three example ads would be effective in reaching consumers.

The content of this email from Alice+Olivia puts some of these ideas into action and takes a stance. The company later announced that they teamed up with No Kid Hungry to further use their platform to do good, and help their audience do good, too.

The Lifestyle Industry’s Increase in Demand

Much like fashion, lifestyle is seeing an increase in click-through rates, but there isn’t the supply to match it just yet.

Lifestyle content is a broad category, encompassing everything from activities to do with kids at home, to cleaning products/tips, and more, so it’s fitting that during this time, people may be taking to the web to find products and resources that fill these lifestyle wants and needs.

Lifestyle Image Trends

Lifestyle image trends show an uptick in including animals and food, and having a female subject.

Lifestyle Keyword Trends

These keyword trends show an interest in lifestyle hacks and the promotion of healthy habits.

Lifestyle Ad Examples

Based on the image and keyword trends for the lifestyle vertical, these are three examples of effective ads.

This post from Seventh Generation is an example of a lifestyle brand getting their message out to consumers right now.

Advertisers Everywhere are Impacted

The bottom line is, everybody feels the effects of scary and uncertain times. People everywhere turn to the open web to find information, to get the products, ideas, or resources they find themselves wanting or needing, and to find out how they can help or how the brands they interact with regularly are helping, too.

Currently, there’s a shift in demand for entertainment, fashion, and lifestyle content. Marketers in these industries, and across other industries, have messages to share with their audiences, and understanding how to best do so is key. There’s opportunities out there for brands to make a difference, and to be a true resource to the consumers they have and the consumers who don’t yet know about them.