Financial topics have been popular reading throughout the pandemic and continue to engage people in the United Kingdom (UK) as they emerge from the on-and-off lockdowns and restrictions that have been in place since the start of 2020.

As most people in the UK are beginning to go back to the office full-time or taking up new hybrid ways of working, money matters seem to have risen to the top of their minds this summer.

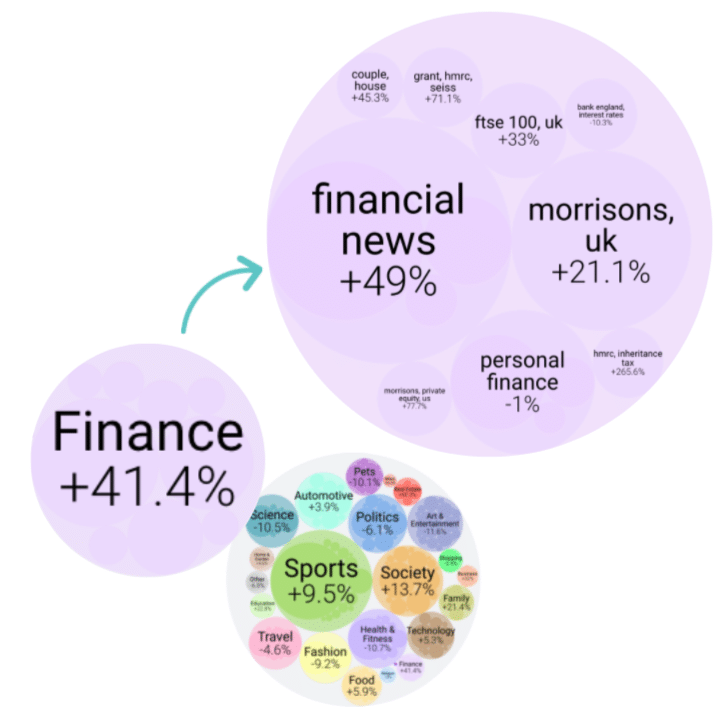

On the Taboola network, there has been a 41.4% increase in pageviews to finance-related articles as of recent.

We analysed data from Taboola Newsroom to learn which financial topics captured the public’s interest this summer. These topics included:

- China, Investment

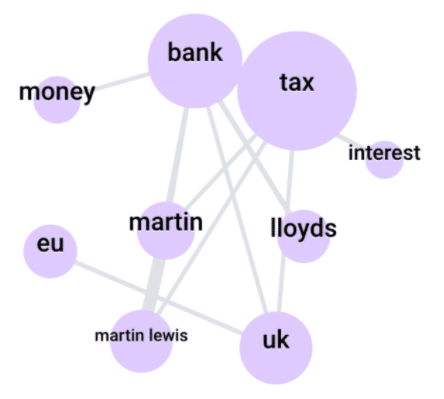

- Bank, Martin Lewis

- Investment, Premium Bonds

- Halifax, Lloyds

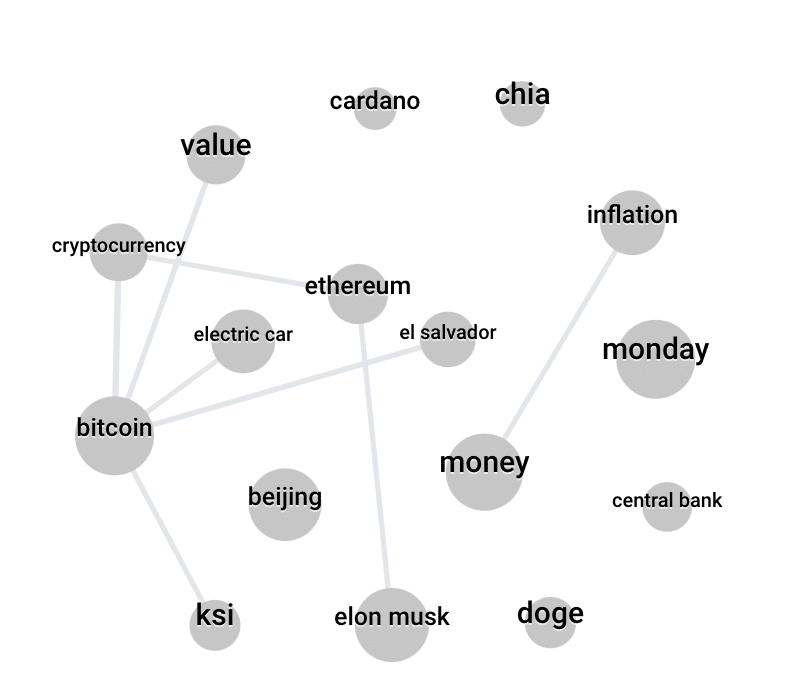

- Ethereum, Price

As the UK starts the long road to financial recovery from the pandemic, investment is certainly on consumers’ minds, with a strong interest shown in the Chinese economy. Popular topics ranged from growing Chinese tech companies like Didi and their IPO on the New York Stock Exchange to China’s investment in the so-called “New Silk Road” countries.

If one public figure dominates consumer finance news in the UK, then it is the ever-present Martin Lewis of the popular Money Saving Expert website. His advice on topics ranging from seeking out bank refunds and getting advice on switching bank accounts to purchasing travel insurance generated an incredible 11m impressions over the past 90 days.

Premium bonds have been a popular investment vehicle for generations of Brits, so it’s no surprise that in times of uncertainty, this safe haven for savings has registered an increase in interest recently. Premium Bonds are often seen as a very safe way to invest money, with the added attraction that investors might snag a big prize in monthly lottery-style giveaways.

The closure of local bank branches is a contentious issue for people in the UK. Halifax and Lloyds came under pressure after announcing branch closures in the last month, and people were anxious to see if their local branch might be impacted.

The rise of cryptocurrency has been fascinating Internet users in the UK for some time, and July was no exception, with significant traffic to articles including terms such as ‘crypto’, ‘Bitcoin’ and ‘Ethereum’. The fluctuating prices of Ethereum and other cryptocurrencies such as Dogecoin also gripped users as they checked to see whether their investments were making them richer or poorer.

Alongside the names of cryptocurrencies, we have also seen traffic to popular related terms such as “Elon Musk,” who recently shared his commentary on Dogecoin on Twitter, as well as in a satirical appearance on Saturday Night Live, causing the cryptocurrency’s stock to first rise, and subsequently tumble.

Here are some more examples of popular articles in the Taboola network in the banking, finance and investment sector:

- Daily Express: Martin Lewis Issues Warning on Premium Bonds Odds

- Russia & China will Lead the World Back to Gold Standard, Investment Manager Tells Keiser Report

- Daily Express: What will Ethereum be Worth in 2030? Ethereum “Difficult to Manipulate” as Value to Soar

With these trends in mind, here are our tips for finance marketers looking to capture the attention of UK consumers as COVID-19 restrictions are relaxed and the economy starts to recover.

Optimise Images and Video

According to our Taboola Trends data, pulled on July 5th 2021, click-through rates get a boost when images include food and drink or use prominent text, as in the examples above. Animals also help to make your images stand out, and photos work better than illustrations. Graphs and spreadsheets can seem a little dull to viewers, so these additions can help to draw them into your campaigns.

Video performs better than still images and text in terms of click-through rates for financial campaigns, opening the perfect creative opportunity to use more video content to increase engagement with your products and services.

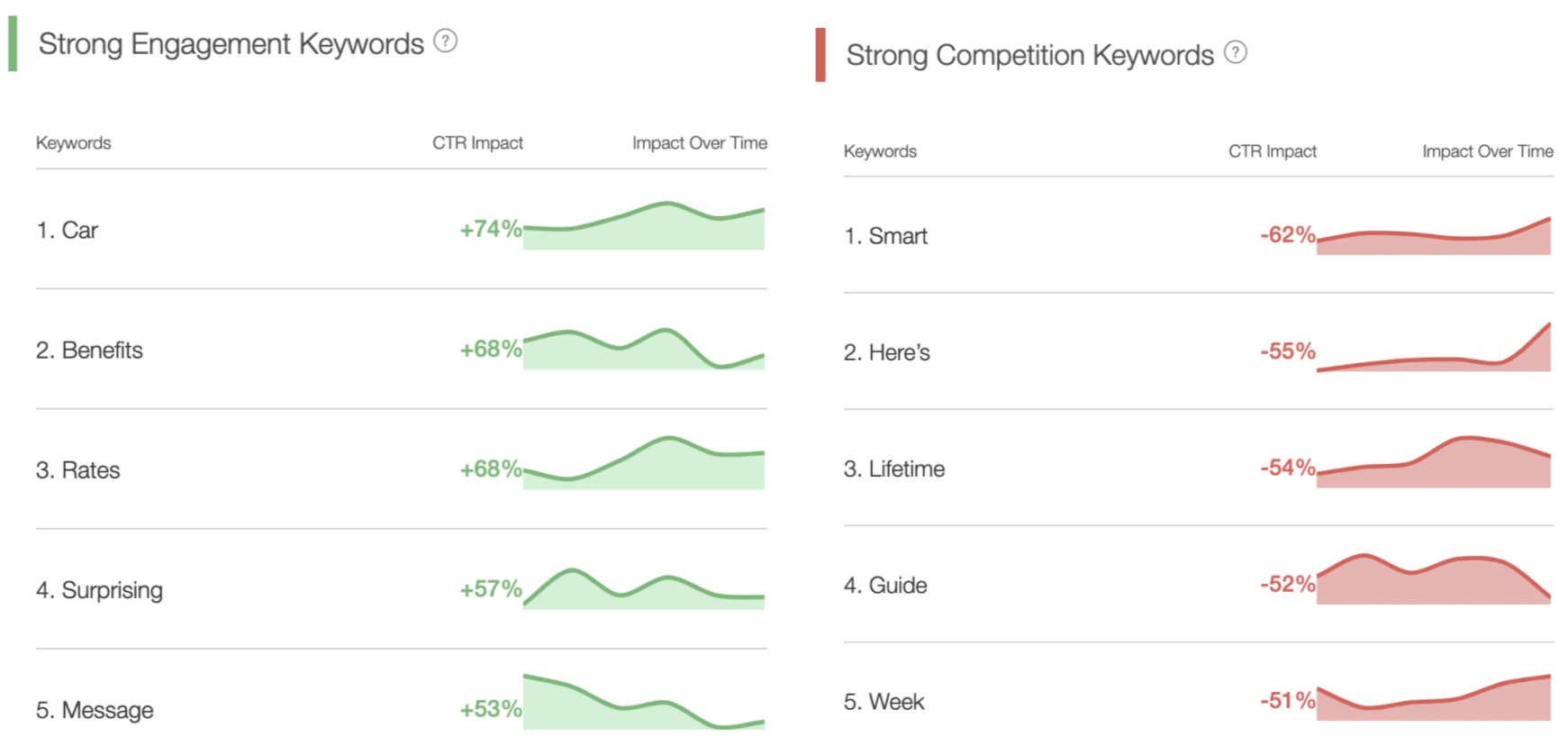

Choose the Right Keywords

The keywords you use in your campaigns can help to attract consumers to your financial services. Using certain keywords, where relevant, can drive greater engagement. In the example above from the Taboola Keyword Trends Tool, you can see the keywords for strong engagement on the left, compared to keywords with higher competition on the right, which should be avoided if possible.

Target the Right Time, Right Day and Right Device

It seems that people in the UK like to make their financial decisions early in the morning and in the late evening, so these are optimum times to upweight your campaigns and reap the rewards in terms of engagement.

Wednesdays and Fridays stand out as good times of the week to run finance campaigns or spend more compared to the rest of the week.

Tablets stand out as the device of choice for those making financial decisions or choosing new finance products or providers. Although there might not be the same volume of inventory available for tablets, they do provide a noticeable uplift in click-through rates.

Learn from Successful Past Campaigns

eToro is a well-known social trading and multi-asset brokerage company. For their acquisition and branding campaigns, they were looking for a new media channel that combined high-quality and scale.

With Taboola, they created a yearly plan to promote custom content, video, and dedicated landing pages, which resulted in over 30% of registrations converting to paying users. Also, their CPM costs were reduced by 40%, as they reached bigger audiences in their target markets.

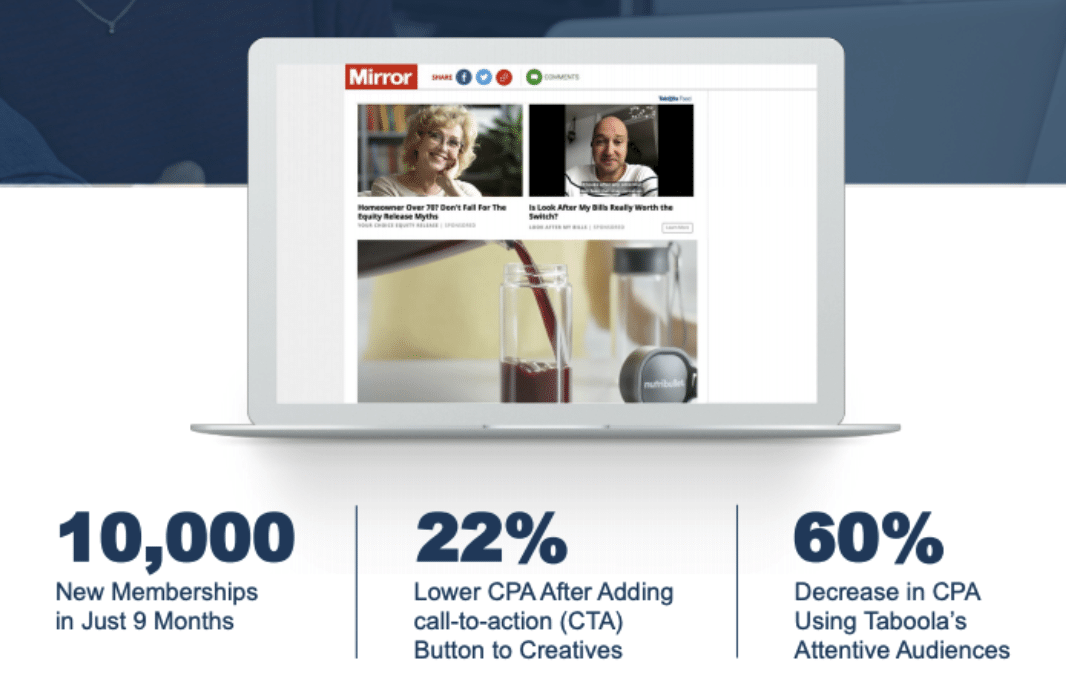

Look After My Bills is an auto-switching service that is dedicated to making energy bills better for customers. They wanted to diversify their media mix beyond Facebook, while increasing memberships at a low cost per acquisition (CPA).

They used Taboola to distribute advertorial content and retarget relevant customers with Taboola Attentive Audiences. The results saw them gain 10,000 new memberships in just nine months. Using Taboola’s Attentive Audiences, Look After My Bills reduced CPA by 60%.

Conclusion

Tapping into consumer finance trends in the UK with Taboola tools can help you run effective campaigns and learn from past successes. Top of mind for consumers, as we slowly emerge from the pandemic, are sectors such as banking and investment. They pay attention to finance gurus such as Martin Lewis, when making decisions and choosing new finance products. Cryptocurrency remains a topic of great interest also.