Find out how Skimlinks, a Taboola company, can help with your affiliate marketing strategy. Learn more here.

As the dust settles from the whirlwind of Black Friday weekend, Skimlinks, a Taboola company, has combed through the data to unveil key trends that emerged during this retail extravaganza. With the shopping phenomenon starting earlier each year, we witnessed shifts and patterns that are reshaping the landscape of consumer behavior and commerce content creation.

From a global outlook to focussed regional perspectives, we dissect the emerging trends, decode consumer behaviors, and spotlight the verticals that were driving the most engagement and conversions across Cyber Week.

Global Overview

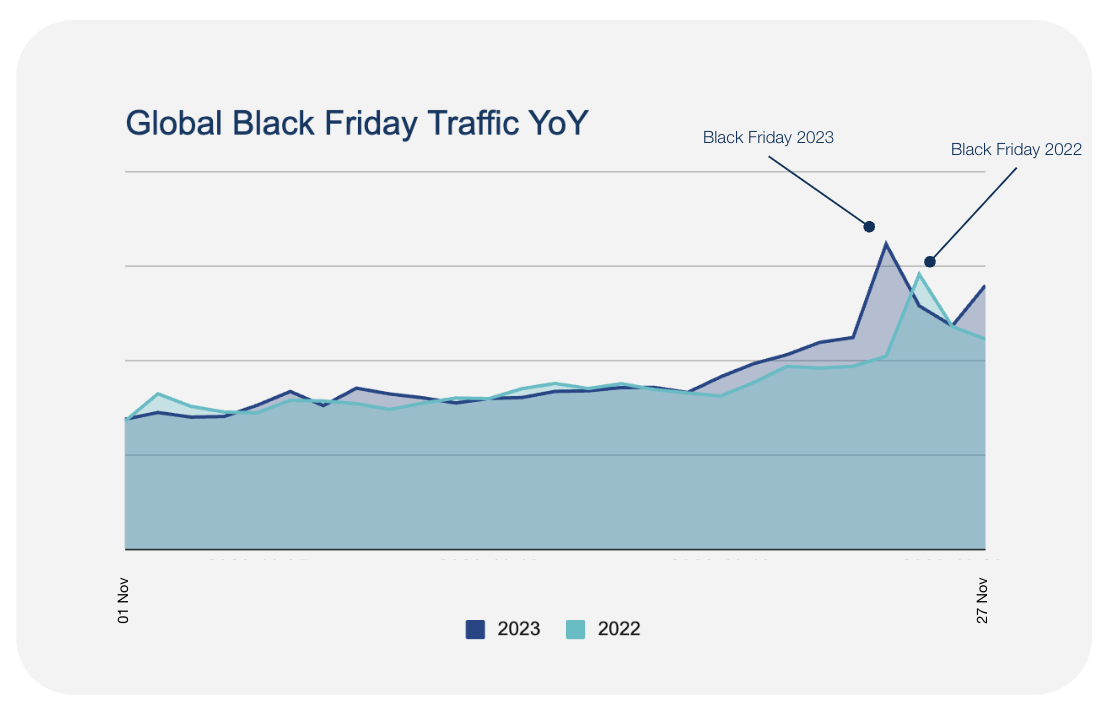

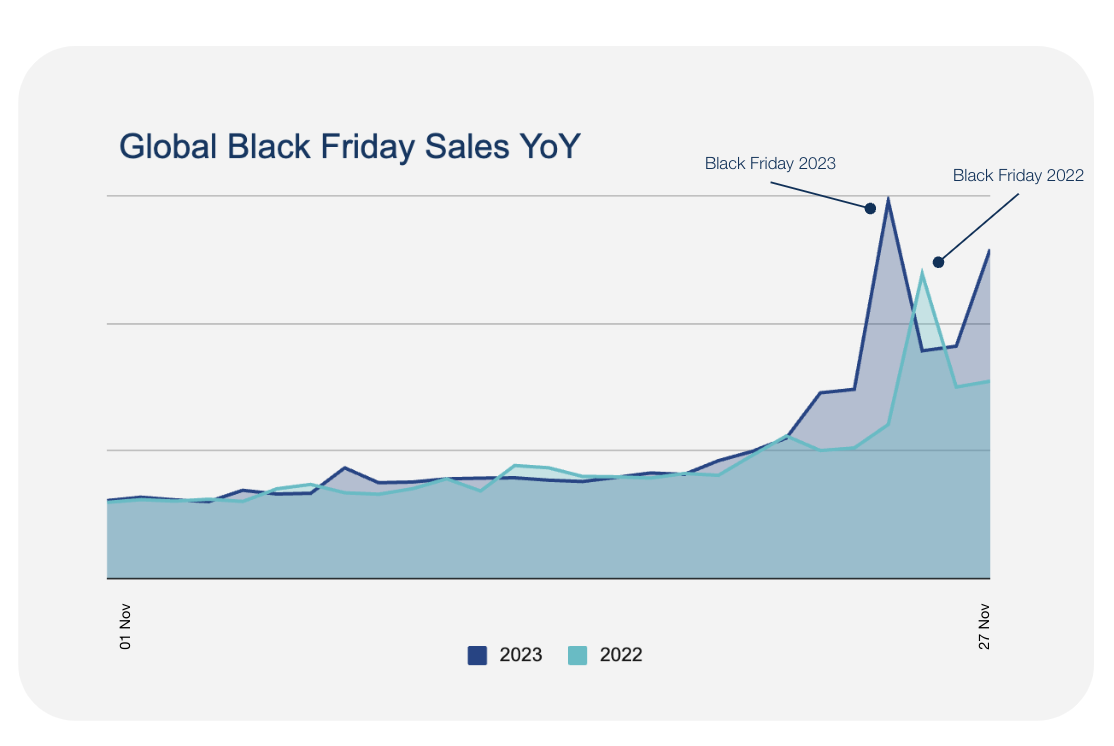

Globally across in the week of Black Friday (20-27 November) we witnessed a +32% YoY uplift in traffic and +31% uplift in commission generated for publishers.

Traffic was up from the start of November but really built in the week leading up to Black Friday and peaked on the day.

Similarly to the trend observed in clicks, sales were concentrated quite heavily to the day itself. However, we did see sales to start picking up earlier in the week than in 2022.

Regional Deepdives

United States

Cyber Week is still pivotal to Q4 shopping

While holiday shopping in the US kicked off earlier than ever before, total consumer spending during Cyber Week surpassed estimates, indicating that this 5-day shopping window remains the focal point of the Q4 shopping season.

Deliberate purchases from US consumers

Across the Skimlinks network, US Managed Publishers’ Cyber Week content generated a staggering 10MM+ clicks from Cyber Week shoppers. When it came time to make purchases, consumers were precise and deliberate with their shopping searches. 42% of the top 100 Cyber Week articles focused on a specific product type or merchant, while other top-performing content highlighted deals from a variety of merchants within a particular category.

Fashion, Sports & Beauty driving the most revenue

This year, the Fashion, Sport & Fitness and Beauty verticals drove the greatest amount of order value for US Publishers, fueled by purchases of cold-weather fashion, athletic apparel and hair tools. Travel emerged as the fastest-growing vertical, achieving the greatest YoY uplifts in terms of traffic (+17%), commission (+21%) and order value (+42%), as consumer demand for travel remains strong.

United Kingdom

Elongated period of impact in the UK

Overall performance in the UK market for Cyber Weekend saw slight uplifts in key metrics including traffic (+6%), average order value (+12%), publisher commission (+29%) and earnings-per-click (EPC) (+22%). Sales and traffic both actually peaked on 25 November (Saturday of Black Friday Weekend), whilst only marginally higher for both metrics than the Friday, it really echoes the sentiment of a prolonged period of shopping as opposed to the historic 24-hour frenzy.

Multicategory retailers such as John Lewis and Boots were top-performing amongst UK consumers. Interestingly, there was a rise in US consumers shopping from UK merchants alluding to the international expansion of the UK ecommerce industry.

Fashion, Travel & Christmas as the top-performers

Fashion and Accessories was top-perfroming with YoY uplifts including: +63.3% sales, +63% order value, +44% publisher commission. That being said, Travel saw the greatest uplifts YoY in the UK, with +226.8% sales and +218% in order value. This is likely as in 2022 there remained some remenense of post-covid anxiety around travel and for the most part that has now cleared. Amongst top-performing articles, ‘Best January Holiday Destinations, ‘Winter Sun’ and ‘Travel Deals’ were popular. This also comes as we see an uplift in the rise of the ‘Travel Tuesday’ phenomenon.

Another returning trend amongst UK consumers was the rise in gifting-specific purchases ahead of the festive season with a +33% uplift in sales YoY for gifting and Christmas. Products such as gift sets or those suggested in ‘stocking filler’ or ‘gift guide’ articles were amongst the top-purchased.

Consumers shopping across the whole of November

Interestingly, whilst still the 4th largest vertical for Black Friday realted articles, home & furniture actually saw a decline on last years sales across Cyber Week. That being said, conversion rate within this vertical was up +12% throughout the lead up from November 1, which reflects the earlier and elongated sales periods a lot of merchants are leaning towards in the UK.

Australia

Black Friday week witnessed a remarkable surge in overall performance metrics across various verticals, showcasing an unprecedented shift in consumer behaviour.

During the period of 20-26 November, WoW clicks increased by +50%, and publisher commission rose by +87%. EPC (Earnings-Per-Click) also skyrocketed to an impressive +24%, and sales saw a +100% spike compared to the weeks leading up to Black Friday.

Home items reigned supreme

Within the trending verticals, shoppers especially flocked to Home items, particularly mattresses and appliances, witnessing noteworthy YoY upticks in various metrics, particularly in publisher commissions (+77%), conversion rate (+60%), EPC (+69%).

Consistent with the early trends findings, sports did well this Black Friday with Sportswear seeing a +164% conversion rate, +232% EPC, and +269% publisher commission during the week.

Interestingly, Travel also emerged as one of the biggest winners during this Black Friday event. It experienced a phenomenal upsurge in publisher commission (+300%), conversion rate (+23%), and EPC (+96%), demonstrating a substantial shift in post-pandemic consumer travel behaviour.

These trends were complemented by articles about comprehensive deals round-ups, brand deals, category-specific offers, and product recommendations, allowing Australian consumers to find products that fit their specific needs.

Most shoppers went shopping at midday

Lunch break means shopping time in Australia, with Black Friday activity soaring during the midday hours. High transaction peaks were consistently recorded between 11 am and 1 pm.

In the hours between 8 and 9 pm, the level of activity rose again, suggesting sustained interest in late-night shopping, as Australians took advantage of last-minute deals before the day ended.

Mobile devices drove sales

Mobile devices were the primary driving force behind Cyber Weekend sales, generating 55% of total sales. Desktops contributed 42% of sales, and tablets accounted for the remaining 3%.

As mobile users increasingly shop online using their mobile devices, mobile optimisation, in-app tracking, and responsive design strategies will become increasingly important.

France & Germany

France and Germany remain traditional

As anticipated in our Early Trends, both Germany and France remain traditional, with sales and clicks both peaking on the day (24 November) and appearing to be relatively isolated to Black Friday itself.

In Germany, traffic was down YoY (-17.6%) as well as sales (-6.6%). However, order value was up by +76.7% as well as EPC (+88%). These metrics suggest German consumers were buying less but spending more. This combination resulted in a +54.9% uplift in commission generated for German Publishers in the Skimlinks network.

In France, we witnessed traffic increasing by +72.9% YoY but sales declining by -19.9%. It appears that French consumers were utilising commerce content to inform their purchasing decisions but perhaps going direct to merchant after doing their research. That being said, overal commission within the French market was up +12.7% YoY in the Skimlinks network for Black Friday 2023.

Beauty and Fashion reign in Western Europe

Top verticals were aligned across both markets with Beauty, Clothing and Footwear reigning at the top. Germany saw greater YoY growth however, with exceptional uplifts across the board for the top verticals (as seen below) and top merchants including H&M, Flaconi DE, Sephora DE, Nike, ASOS, Mango and Doc Martens.

| Germany Top Vertical Performance | ||

|---|---|---|

| Sales | Order Value | |

| Beauty | +215.5% | +303.8% |

| Clothing | +97.9% | +206.5% |

| Footwear | +86.5% | +177.4% |

France also saw growth in sales across Beauty (+28.8%) and Clothing (+17.6%), but in fact saw the greatest growth in the Home vertical (+67.4% sales, +15.6% order value) and in particular, Bedding, which saw a +147.8% uplift in Sales YoY.

Hong Kong, Taiwan, & Singapore

Black Friday was a great success across Hong Kong, Taiwan and Singapore this year. Year-on-Year uplift of each key metric shows that more consumers are making online purchases than last year and merchants and publishers are enjoying a more profitable seasonal shopping event than ever before.

| Publisher Commission | Order Value | |

| Hong Kong | +38.6% | +47% |

| Taiwan | +63.5% | +33.2% |

| Singapore | +74.9% | +136.8% |

Similar vertical trends across Hong Kong and Taiwan

This year, Luxury Fashion & Accessories, Sports Apparel and Travel emerged as standout performers among various verticals in Hong Kong and Taiwan. Strong growth in Average Order Value underscored a growing consumer inclination towards investing in premium products during the Black Friday shopping frenzy. Luxury Fashion as a vertical saw a +104% increase in Average Order Value in Hong Kong and +183.5% uplift in Taiwan. Demmellier has significantly increased the overall profitability this season. In particular, this article showcases the top-selling products in the region, accompanied by an early access code. High audience engagement is the outcome of collaboration between the Vogue Taiwan editorial team and the Skimlinks Editorial Network.

Travel is another vertical that performed strong this year. Particularly in Hong Kong, we witnessed +62.5% in Publisher Commissions and +76.4% in Order Value for Travel related content. Notably, KKday’s 9th Anniversary Daily Flash Deals during Black Friday marked a standout offering in the midst of the bustling promotions.

Electronics and Home Appliances reigned in Singapore

In Singapore, Electronics (+162.3% in Traffic YoY) and Home Appliances (+172.6% in Traffic YoY) stand out as the two most powerful verticals generating substantial revenue. Consumers are utilising the discounts to make higher-ticket items that fall into these verticals.

Both Marketplaces and Brands offered significant discounts on a wide range of products, including Smartphones as well as Vacuum Cleaners and Beauty Products. The Beauty vertical, in particular, has demonstrated strong performance this year (+40% in Traffic and +19% in Publisher Commissions). From basic anti-aging skincare to beauty gadgets, Singaporean audiences are enthusiastic about the various beauty deals available.